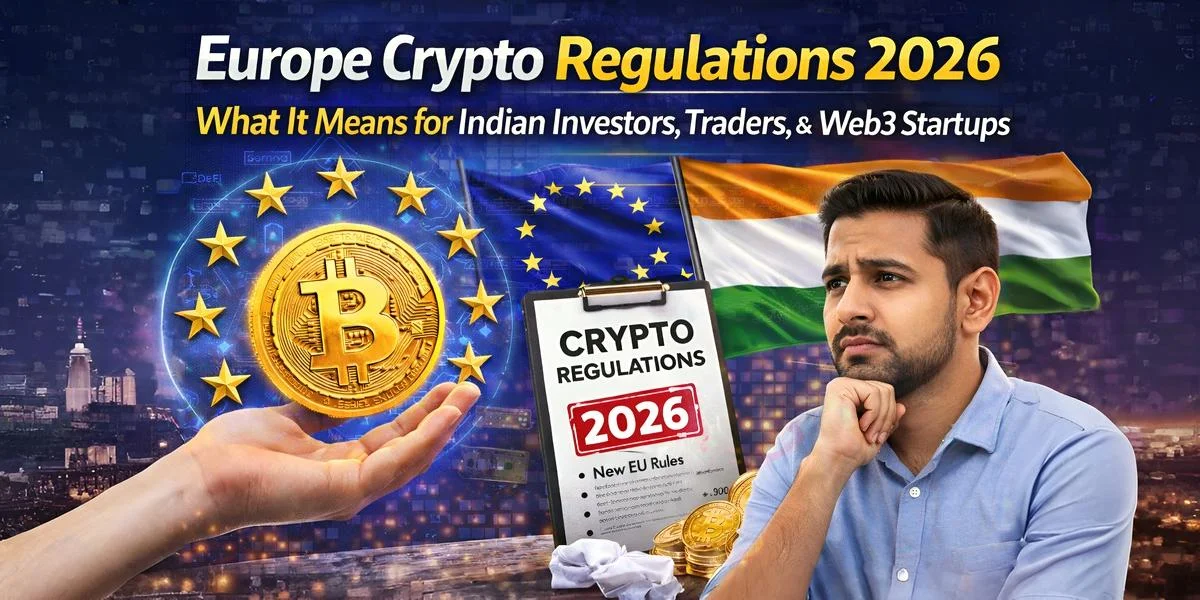

Europe Crypto Rules Impact on Indian Investors: Major Changes Coming in 2026

Europe crypto rules impact on Indian investors

Table of Contents

Introduction: Why Indian Crypto Users Are Suddenly Talking About Europe

Till recently, most Indian crypto users didn’t bother much about what was happening in Europe. The focus stayed on Indian rules, Indian taxes, and whatever updates came from the government here.

That situation has started to change.

Europe crypto rules impact on Indian investors is now being discussed more seriously, not because of hype, but because Europe is actually putting clear rules on paper. While India is still uncertain, Europe is moving towards a structured crypto framework.

If you are involved in crypto, these questions might already be on your mind:

Does Europe offer more clarity than India right now?

Will Indian users face restrictions on European exchanges in the coming years?

Is it risky to ignore what Europe is planning?

These aren’t imaginary concerns. Indian crypto users are dealing with high taxes, unclear regulations, and sudden policy shifts. Planning long term under such conditions is difficult.

Because of this, many Indian investors and traders are slowly looking outside India. Europe is getting attention not because it is perfect, but because it is trying to bring consistency through regulations like MiCA and DAC8.

By 2026, Europe’s crypto ecosystem will look very different. And even though these rules are meant for Europe, Europe crypto rules impact on Indian investors who trade globally, use international platforms, or work in Web3-related roles.

This article looks at what is changing in Europe, why Indian crypto users should care, and what practical risks and opportunities may come up in the process.

Why Indian Investors Should Care About Europe’s Crypto Future

India is one of the largest crypto-using countries in the world, yet the biggest problem Indian users face is uncertainty.

The current Indian crypto problems:

- 30% flat tax on crypto gains

- 1% TDS on every transaction

- No clear long-term crypto law

- Frequent exchange restrictions

- Banking and compliance confusion

Because of this, many Indian users:

- Use international exchanges

- Explore offshore Web3 opportunities

- Look for stable regulatory environments

Europe, unlike India, has chosen a clear regulation-first approach. By 2026, Europe aims to become one of the most regulated yet crypto-friendly regions in the world.

For Indians, this means:

- More safety

- Clear compliance

- Long-term stability

What Is MiCA and Why It Matters to Indians

MiCA (Markets in Crypto-Assets Regulation) is Europe’s first unified crypto law.

The problem MiCA solves:

Before MiCA, every European country had different crypto rules—just like the confusion we see in India today.

MiCA fixes this by:

- Creating one rulebook for all EU countries

- Regulating crypto exchanges, wallets, stablecoins, and service providers

- Protecting users from fraud, scams, and misuse

Why MiCA matters for Indian users:

If you are an Indian using or planning to use a European crypto platform, MiCA means:

- Exchanges must be licensed

- Funds must be properly segregated

- Transparency is mandatory

- Consumer protection is stronger

In simple words:

👉 Less risk of sudden exchange collapse or fund freeze

DAC8: The End of Anonymous Cross-Border Crypto

One of the biggest concerns for Indian users is tax tracking.

DAC8 is a European rule that focuses on crypto tax reporting.

The problem DAC8 addresses:

Governments worldwide struggle to track cross-border crypto transactions.

DAC8 solves this by:

- Forcing exchanges to collect user data

- Sharing transaction details with tax authorities

- Tracking cross-border crypto movement

What Indians need to understand:

If you are:

- Using EU exchanges

- Moving crypto between India and Europe

- Running a Web3 startup with EU clients

Then DAC8 means:

- Transparency will increase

- Anonymous activity will reduce

- Proper tax planning becomes important

👉 This doesn’t mean “crypto ban”—it means regulated crypto.

Can Indians Still Use European Crypto Exchanges in 2026?

Short answer: YES, but with conditions.

By 2026:- European exchanges will be more strict

- KYC and compliance will be mandatory

- Some unregulated platforms may exit the market

For Indian users:

✔ Regulated EU exchanges will still accept Indian users ✔ Proper KYC and documentation will be required ✔ Suspicious or non-compliant accounts may be restrictedGood news:

Legitimate Indian users will benefit from safer platforms and better transparency.Europe vs India: A Simple Crypto Regulation Comparison

Area | India | Europe (2026) |

Legal clarity | Unclear | Clear & unified |

Crypto tax | High & rigid | Structured & transparent |

Exchange regulation | Partial | Fully regulated |

Stablecoin policy | Unclear | Clearly defined |

Institutional adoption | Limited | Strong & growing |

This comparison explains why Indian investors are watching Europe closely.

Opportunities for Indian Web3 & Blockchain Startups

Europe’s crypto clarity creates big opportunities for Indian founders.

Key opportunities:

- Launching MiCA-compliant Web3 products

- Serving European clients legally

- Access to EU investors and funding

- Building regulated crypto infrastructure

Many Indian startups are already:

- Registering EU entities

- Building compliance-first Web3 solutions

- Targeting European users instead of Indian retail

👉 Europe could become a global playground for Indian Web3 talent.

Risks Indian Users Must Not Ignore

No system is perfect. Europe’s regulation also comes with challenges.

Potential risks:

- Higher compliance cost

- Stricter KYC norms

- Reduced anonymity

- Strong tax reporting

For Indian users, the solution is simple:

✔ Keep records

✔ Understand tax obligations

✔ Avoid shady platforms

✔ Focus on long-term strategy

Practical Advice for Indian Crypto Users (Actionable)

If you are serious about crypto in 2026, here’s what you should do today:

- Prefer regulated international exchanges

- Maintain transaction history properly

- Understand India + global tax implications

- Avoid short-term speculation

Focus on learning compliance-friendly crypto usage

Final Verdict: Should Indians Look at Europe for Crypto in 2026?

Europe is not trying to kill crypto.

Europe is trying to professionalize crypto.

For Indian investors, traders, and startups:

- Europe offers clarity

- Europe offers stability

- Europe offers long-term opportunity

If India delays regulation clarity further, Europe may become the preferred global crypto hub for Indian users. Overall, Europe crypto rules impact on Indian investors will depend on how Indian traders adapt to EU crypto regulations and MiCA compliance.

Read More.....

What Is Cryptocurrency? A Comprehensive Beginner’s Guide for India

Zero coding से SaaS बनाएं: faceless channel ideas + online earning no-code tools से

FAQs

Is crypto legal in Europe for Indians?

Yes, Indians can legally use European crypto platforms, subject to compliance and KYC rules.

Will Europe ban crypto in 2026?

No. Europe is regulating crypto, not banning it.

Can Indian startups register crypto companies in Europe?

Yes, many Indian Web3 startups already operate legally in EU countries.

Is Europe safer than India for crypto investors?

From a regulatory clarity perspective, Europe offers more certainty than India as of now.